Why are Stocks Recovering as the Economy Declines?

June 10, 2020

Since hitting record lows in March, the stock market has made quite a rebound, with the S&P 500 up more than 36% through the end of May. Not only did the COVID-19 pandemic catalyze one of the quickest bear market drops in history, but also one of the fastest rebounds!

How can stocks be soaring if the economy isn’t getting any better? How can we account for this timely bounce back without any key performance indicators to signal a recovery?

Optimism. It isn’t something many Americans have been able to hold onto during this COVID-19 financial crisis. From small business shutdowns, record-high unemployment levels, and the launch of the largest economic relief effort ever passed in US history under the CARES Act, there has been little for the country to rally for since mid-February.

However, the stock market may be indicating that some shreds of optimism are starting to circulate even though the US economy seems to be in free fall.

Investor sentiment, the Fed, and FOMO.

At this point in time, consumers seem to be willing to look past the absence of revenue and earnings, the skyrocketing unemployment level, and the burgeoning amount of corporate and sovereign debt to better days ahead. Perhaps the partial re-openings of the economy in over 30+ states or rumors of a vaccine are giving promise to a speedy recovery. Maybe they believe that the economic stimulus efforts will be enough to bridge the gap until the economy is fully re-opened. Either way, the strong market rebound indicates that something is keeping investor confidence afloat and distanced from the deafening requiem of our eleven-year bull market. What could it be?

Of course, moves by the Federal Reserve and the liquidity created by Congress with the CARES Act have flooded the markets to help carry them through “the worst of it.” But, from a market psychology standpoint, many investors are throwing funds into the stock market because of (1) 10-year record-low yields on bonds and (2) stock market “FOMO,” or “fear of missing out” on gains made in the inevitable market recovery. In fact, investors with the extra capital have spent the past 6-8 weeks doubling down on stocks while the assets were offered at seriously depressed prices.

The outlook remains to be seen.

Don’t be fooled, though. Not all stocks are on the rise. There is a dramatic difference in the way certain sectors are performing. Retail stores and travel have only recovered marginally since the decline, indicating they may not make it through the brighter days—or, if they do, under the guise of a different name, e.g. new ownership. Big Tech, on the other hand, such as Microsoft, Amazon, Alphabet, Apple, and Facebook, which account for more than 20% of the S&P’s total value, appear likely to emerge from the crisis unscathed.

No one knows how long investors will cling to their last shreds of optimism or how long the markets will continue to rise as the economy falls. As always, the shape of the economic rebound is unpredictable. Macro and micro events, which influence investor sentiment, can cause major buy-ins and sell-outs at a moment’s notice. One positive or negative event can cause stock market prices to change in an instant.

Markets Recover Quicker Than You Think

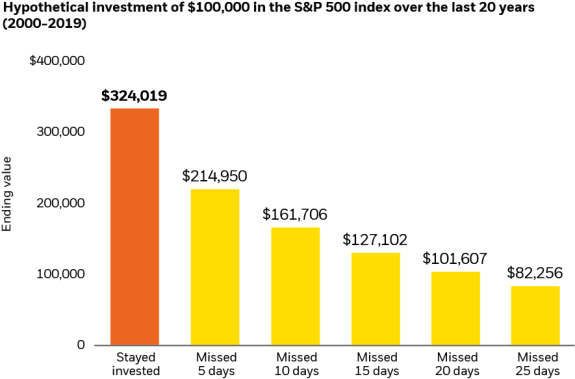

While the COVID-19 pandemic may be a battle we have never fought, this type of uncertainty is not new to the market. In fact, this type of back-to-back decline and recovery occurs more often than one may think. According to the annual J.P. Morgan Asset Management “Staying Invested During Volatile Markets” report, which examines a rolling twenty year period, one statistic has remained relatively unchanged: roughly 60% of the S&P 500’s largest one-day gains occur within two weeks of its 10 largest single-session losses. In other words, the best trading days often occur within only two weeks of the worst, and missing out on even a handful of the market’s best days can substantially erode a portfolio’s value over time (Figure 1[i]).

Source: BlackRock, Bloomberg as of March 2020.

When investors sell during a panic to try and wait out the storm, they risk missing out the market’s best days and their portfolio suffers as a result. By staying fully invested over the past 20 years, the hypothetical investor above would have earned $109, 069 more than someone who missed even just the market’s best 5 days.

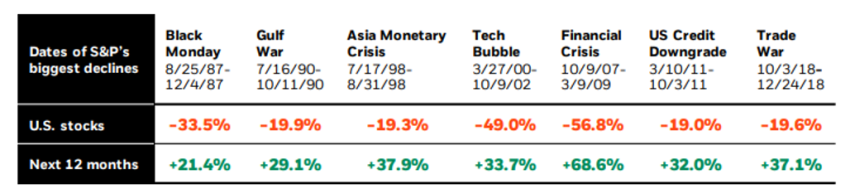

The bottom line is that markets recover and oftentimes more quickly than we might think. Because downturns cause discomfort and even anxiety or fear, they can feel as if they are lasting a lifetime. But, in reality, the market has recovered from many macro-induced bear markets in as little as a year (Figure 2[ii]). Most recently, the S&P 500 tumbled more than 10% on fears of a US-China trade war agreement and Fed policy error in the fourth quarter of 2018. Stocks routinely recover from short-term crisis events to move even higher in the near future.

Source: Morningstar as of 2/28/20.

If the above data underscores anything, it’s the importance of staying diversified and avoiding the impulse to try and “time” market movement by panic selling. Markets are irrational and tend to overreact over short periods of time, but they are also resilient. In just the past 20 years, natural disaster, political turmoil, and societal changes have all had their turn at giving investors a scare. COVID-19 is just the next event that will be added to our history.

At Williams Asset Management, we understand that volatile markets can be unnerving. We also know that you may have questions or concerns about your financial plan at this time. Because it is our job to guide you through these difficult circumstances, we encourage you to reach out to us at any time regarding these or other matters.

[i] Stocks are represented by the S&P 500 Index, an unmanaged index that is generally considered representative of the US stock market. Past performance is no guarantee of future results. It is not possible to invest directly in an index. For illustrative purposes only. It serves as a general summary, is not exhaustive and should not be construed as investment advice. The strategy described are hypothetical and conceptual.

[ii] Returns are principal only not including dividends. U.S. stocks represented by the S&P 500 Index. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You can’t invest directly in an index.

Share on socail media: