When life is busy, it’s easy to promise yourself you’ll “start saving later.” The catch is that retirement accounts don’t just grow with what you put in—they grow with time. And time is the one ingredient you can’t make up. Starting earlier, even with small amounts, can make reaching your goals easier and less expensive in the long run.

Why Waiting Can Be Costly

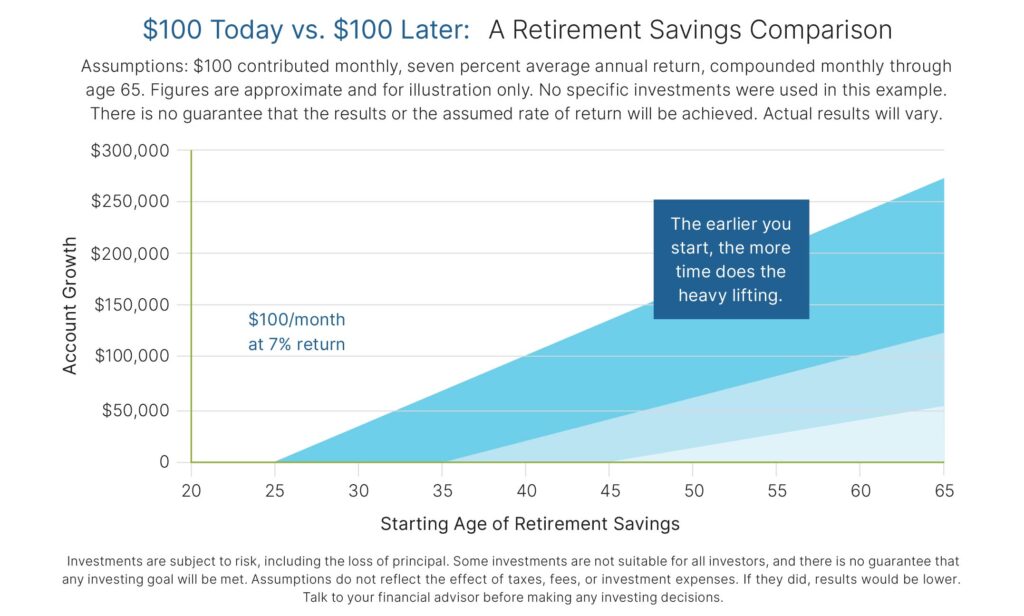

When you delay saving, you’re not only skipping contributions, you’re also losing time for your money to earn interest (or investment returns) and for that interest to earn even more. This process is known as compound growth, and it’s one of the most powerful forces in long-term savings. Here’s how it works:

- When you contribute to a retirement account, those dollars can earn interest or returns based on the investments inside the account.

- The next year (or month, depending on the compounding), you don’t just earn interest on your original contribution—you also earn interest on the interest that was added.

- Over time, this creates a snowball effect; your savings grow faster because each layer of earnings adds to the base and generates more growth.

When you wait to start saving, you shorten the timespan for your money to compound. Missing even a few early years means multiple layers of that “interest on interest” effect are never realized. To reach the same goal, you’ll likely need to contribute much more each month, because your money has fewer years to do the heavy lifting for you.

That doesn’t mean it’s ever too late to start—it simply means the earlier you begin the more time works in your favor.

How to Start (and Keep Going)

You don’t have to contribute large amounts to make meaningful progress. What matters most is starting and being consistent.

- If saving feels difficult, start with what fits your current budget and plan to increase it gradually. Many people raise their savings rate by 1% each year or after a raise, so the change goes almost unnoticed.

- If your employer offers a retirement plan, try to contribute enough to receive the full employer match. That’s considered ‘free money’ added to your savings.

- If you’re self-employed or working in the gig economy, there are retirement accounts designed just for you. These plans let you save for retirement with some tax advantages—similar to a 401(k) at a traditional job. Two worth checking out are the Solo 401(k) and the SEP IRA (Simplified Employee Pension IRA). A financial advisor or tax professional can help you decide which fits your situation best.

The main point is simple: getting started matters more than getting it perfect. Every dollar saved today has more time to grow.

Why Time Is the Secret Ingredient

The biggest advantage of starting early isn’t about how much you save, but how long your money can stay invested. The longer your money stays in an account that earns a return, the more opportunities it has to grow.

Markets naturally move up and down, so growth won’t be the same every year. But history shows that, over decades, staying invested through the ups and downs tends to reward patience. Even moderate, steady growth can make a significant difference when you give it enough time.

Adapting to Your Stage of Life

Saving looks different at each stage of life—and that’s normal.

- In your 20s and 30s: Focus on creating a habit. Automate contributions so you don’t have to think about them.

- In your 40s and 50s: Review your savings rate and goals. If your income has grown, increasing your contribution can help you take advantage of your higher earning years.

- In your 50s and 60s: Many retirement plans allow extra “catch-up” contributions once you turn 50. This can help boost your balance before retirement.

Your financial advisor can help you balance your current needs and long-term goals, but no matter your age, the goal is consistency. Small, steady actions—kept up over time—make a larger difference than sporadic bursts of effort.

Delaying retirement contributions may feel harmless, but it can quietly reduce your financial flexibility later. The sooner you begin—even with small amounts—the more time your money has to grow. You don’t need to be perfect. You just need to begin.