Latest News & Viewpoints

Williams Asset Management Selected as Winner of 2025 Best Workplaces in Money Management

Read More

Building Your Financial Dream Team

Read More

Williams Asset Management Selected as a 2025 Finalist for Financial Planning Excellence by Baltimore Magazine Readers

Read More

How to Choose Between Buying and Leasing a Car

Read More

Preparing for Retirement: Four Essentials to Consider

Read More

Smart Homeownership Strategies in a Changing Market

Read More

Retirement Beyond the Numbers: Finding Purpose, Connection, and Fulfillment

Read More

Managing Health Care Costs in Retirement

Read More

What You Should Know Before Naming a Minor as a Beneficiary

Read More

Our Latest Monthly & Weekly Market Navigator

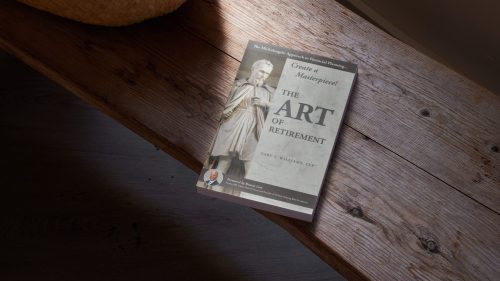

The Art of Retirement

Written to serve as an inspirational retirement planning guide, The Art of Retirement is meant to help you along life’s journey by exploring the story of Michelangelo’s life and art as a parable to show you how you can create your own life’s masterpiece. All profits from book sales go directly to charity.