An Introduction to Alternative Investments – Part II

August 13, 2022

Understanding the Types of Alternative Asset Classes

The universe of alternative investments is constantly expanding, with choices ranging from private equity funds to real estate to hedge funds, employing complex hedging strategies using options, derivatives, and futures contracts. Here are some of the more popular alternative investments used by investors in an attempt to enhance returns, minimize volatility, or do both

Real Assets: Commodities and Real Estate

Commodities1 tend to perform well in inflationary environments. The value of commodities, such as precious and industrial metals, agricultural products, and energy, have historically kept pace with inflation. In the beginning of 2022, several factors converged to drive commodity prices to their best returns in decades, including pent-up demand, the Ukraine war, and Russian sanctions.

Investors have recently been looking to commodities as diversifiers and safe-havens. However, while commodity prices have been rising, they tend to be very volatile and may not be considered appropriate long-term investments. With concerns increasing recently over a potential global growth slowdown, the risk of a sudden reversal for commodity prices has also risen.

While it’s possible to own tangible commodities, such as gold bars, most investors prefer to invest in exchange-traded funds (ETFs) or mutual funds that track the price of commodities with futures contracts or invest in commodity producers, such as energy companies.

Real estate can also be an excellent inflation hedge, with values actually exceeding the inflation rate over the last several decades. Most people think of their homes when they hear the phrase real estate, but there is a whole universe of commercial real estate that can provide additional diversification to a well-balanced portfolio. Investors can participate in these growing real estate values and income by investing in real estate investment trusts (REITs).

Hedge Funds

Hedge funds2 are alternative investment funds that pool money from investors to invest in nontraditional investment strategies. The underlying investment is typically equities, but they can employ many strategies to generate positive returns while mitigating risk. The ultimate goal is to generate positive returns regardless of how the markets are currently performing. They attempt to do this by “hedging” their portfolios, using various financial instruments, such as options or market strategies.

Private Credit

Private credit is an asset class consisting primarily of negotiated loans and debt financing from non-bank lenders. In a gradually rising rate environment, private credit can be attractive because loans typically have a short maturity of nine months or less that adjust with prevailing rates and tend to have higher yields than traditional bonds.

Private Equity

Private equity investments are growing in popularity for investors who don’t need access to cash in the short term and have a longer investment horizon. The number of publicly traded companies in the United States has declined significantly over the past quarter century and the opportunity set for privately owned companies is much larger. Generally, private equity investments are only open to institutional and accredited investors.

Implementing an Alternative Investment Strategy in Your Portfolio

How you choose from among so many alternative investment options depends mainly on your appetite for risk and time horizon. Generally, alternative assets fall within one of two categories: Diversifiers or Enhancers.

A return diversifier is an asset with a low correlation to other assets that can be added to your portfolio to reduce risk across the overall portfolio.

A return enhancer is an asset with the potential to generate a higher average return.

Ideally, a portfolio should include some combination of diversifiers and enhancers to produce the desired outcome of higher expected returns and a lower level of risk (i.e., heavier on enhancers if the primary goal is higher absolute returns).

In most cases, investors use alternatives to diversify their portfolios but select specific options based on their particular objectives. For example, real estate is typically chosen as a hedge against inflation and its ability to generate reliable, long-term income. In contrast, private equity is selected for the potential for higher absolute returns through capital appreciation.

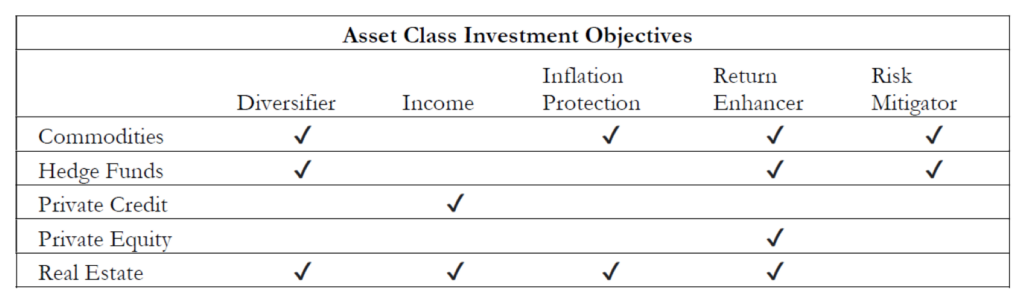

The following chart reflects, in general terms, the dominant characteristics of five asset classes: Commodities, Hedge Funds, Private Credit, Private Equity, and Real Estate. Notice that three asset classes—commodities, hedge funds, and real estate—can address several objectives.

The key is understanding your overall investment objectives and what you want an alternative investment to achieve for your portfolio. Are you looking to enhance your income or investment returns? Are you attempting to hedge against inflation, or is risk mitigation your primary concern? As with any investment portfolio, the best outcome can usually be achieved by seeking exposures to multiple asset classes.

Next, you need to understand your circumstances. Will you need to access cash from your portfolio in the short term? If so, it may be recommended to refrain from investing in illiquid alternatives such as private equity, hedge funds, and closed-end real estate investment trusts (REITs), which all tend to have minimum holding periods of a year. Are you primarily concerned about the long-term impact of inflation on your portfolio? Then focus on commodities or real estate, or a combination of both.

Work with a Qualified Financial Advisor

Alternative investments tend to be complex, and some of them have high minimum requirements along with extended holding periods. Information on most of these asset classes is not available to the general public, and not all financial advisors routinely deal with alternative investments. It takes specific expertise and experience to understand how alternative investments should be added to a portfolio to achieve the desired mix of diversified assets that can result in an optimal risk-return dynamic in your portfolio. Any alternative investment strategy should be tailored to your particular objectives, circumstances, and risk tolerance.

Although the alternative investment space can be intimidating, research has shown that alternative strategies can make a significant difference in a portfolio’s risk/return characteristics. So, while alternative investments might be a great avenue for you to explore, we recommend consulting with your financial professional before making any major changes to your portfolio.

Working with a financial planner can help you navigate life’s more challenging financial situations. If and when you decide to enlist the help of a professional, look for the right experience, certifications, and knowledge-base you need to handle your situation.

Let the CERTIFIED FINANCIAL PLANNER® professionals at Williams Asset Management help with your wealth management needs. Whether you need comprehensive and holistic financial planning or investment management, we can help! We are fee-based, independent financial advisors located in Columbia, the heart of Howard County, Maryland. Schedule your complimentary consultation today by calling (410) 740-0220!

1 Investments in commodities may have greater volatility than investments in traditional securities. Specific commodities industries are affected by world events, government regulations, and economic and political risks. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or world events, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political, and regulatory developments. Use of leveraged commodity-linked derivatives creates an opportunity for increased return but, at the same time, creates the possibility for greater loss.

2 Hedge funds are speculative and not suitable for all investors. The risks include, but are not limited to, the following: The funds may be leveraged; investors could lose all or a substantial amount of their investment; higher fees and expenses may be charged, which may increase the risk that returns are reduced; performance can be volatile; the funds are illiquid and there may be restrictions on transferring fund investments; and there are other specific risks related to particular fund’s investment strategies. Investors must meet specific suitability standards before investing.

Investing in alternative investments may not be suitable for all investors and involves special risks, such as risk associated with leveraging the investment, utilizing complex financial derivatives, adverse market forces, regulatory and tax code changes, and illiquidity. There is no assurance that the investment objective will be attained.

This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation.