Suitability vs. Fiduciary Standards… It Matters!

February 5, 2019

If you are anything like us, you are always busy — right?

We tend to make time for what is most important to us but never seem to be able to achieve everything we want to accomplish. I’m sure there are things you would like to learn if you had the time to train or study. For example, playing a musical instrument or speaking (another) foreign language are probably popular bucket list items.

Personally, managing your hard-earned wealth may be another. However, determining if you should manage your investments, in our opinion, boils down to three simple criteria: time, training and temperament. If you don’t have the time to manage your investments, then it doesn’t matter if you have the training or even-keeled temperament. Perhaps you have studied and understand the “how” of managing your investments but you don’t have the ability to make unemotional, rational decisions. In these cases, you would hopefully realize you need the help of a professional. Herein lies the basis for this blog: what criteria do you use to select a financial advisor. With so many “advisors”, how do you select the best one for your unique situation? While there are many different attributes you want to consider, we are going to focus on one, in particular, today: whether the advisor is legally obligated to look out for your best interests.

Unfortunately, there are many professions that do not require this standard of care. These include some of the largest financial transactions we can encounter: selling your home, automotive purchases, and life insurance, to name a few. In these industries, the salesperson or agent may not work in a fiduciary capacity. In other words, they do not legally need to act in your best interests. This can be true in the financial services industry as well.

Let’s suppose you are meeting with your financial advisor and she suggests you invest your $500,000 IRA into an annuity. She explains all of the features of the product along with the “bells and whistles”. You say, “This sounds great. Let’s purchase this product”. But was this in your best interests simply because your financial advisor suggested it? Possibly not. Or perhaps, your life insurance agent suggests you “invest” in a variable universal life insurance policy “to protect your family”. Is this in your best interests? Maybe. Maybe not.

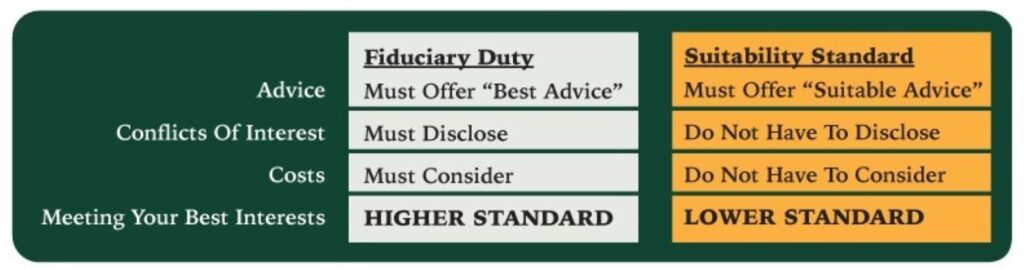

You see, there are two very different standards when it comes to financial advice: the Suitability Standard and the Fiduciary Standard. While we are going to focus our attention on the Fiduciary Standard, you can read more about the Suitability Standard here.

In today’s financial advising industry, the Fiduciary Standard is as important as ever. In Q2 of 2016, the Department of Labor (DOL) released new rules stating that financial advisors must perform certain due diligence to help ensure that a client’s 401(k) plan assets and individual retirement accounts (IRAs) are invested prudently. Unfortunately, most consumers have no idea about these rules and therefore they believe their financial advisor is looking out for their best interests. This is certainly not the case, but the difference undeniably matters.

It is important to recognize that advisers can earn their income either using a commission-based or fee-based compensation system. The former is where the Suitability Standard falls, meaning the advisor sells you an investment product such as an annuity. This annuity might be suitable for you, but you might not need it financially because you already have a healthy income stream during retirement due to pensions. The advisor can make a healthy commission up-front from the sale of this annuity but what incentive does he then have to monitor your account or provide you with exceptional service – she has already been compensated!

The latter is what the industry is shifting towards, and goes hand-in-hand with the Fiduciary Standard. When a firm is fee-based, they are incentivized to provide ongoing service, day after day, that is cost-efficient, and that correlates with your goals and tolerance for risk.

The bottom line is that choosing an advisor following the Suitability Standard versus one that follows the Fiduciary Standard does matter! You worked hard for your money, and trusting someone to manage it for you can be unsettling, but it can provide you with greater comfort knowing that you are working with an advisor who truly is acting in your best interests. With all of this in mind, you may find it prudent to discuss the difference between these standards with your financial advisor and determine if your current situation is right for you.