Investing Can Be Like Playing a Game of Monopoly

February 5, 2019

Remember playing Monopoly with your kids or as a kid? It’s a game of strategy and most of us choose one of two ways to go. The first way is to spend most of our cash on a high-end property like Park Place or Boardwalk in the hopes that we will score a big profit when the other players land there. The other strategy is to purchase a combination of high-rent and low-rent properties to spread out our investments.

For anyone who has played the game of Monopoly, the thrill of another player landing on your Boardwalk property, where you have built a hotel, is exciting. This is somewhat like putting all of your money into an investment that tracks the S&P 500 Index and having a year like 2014 when your portfolio was up over 13%. On the other hand, the player who invests in both the higher-end properties as well as some of the low-rent districts may also have a very good chance of winning the game. Let’s go through some data that will prove, historically speaking, that a diversified portfolio is a better way to invest than simply the S&P 500 Index. In keeping with my Monopoly metaphor, this would be akin to purchasing various valued properties and not just the most expensive rents.

Chasing Returns

In our combined 26 years as investment advisors, we value and understand the benefits of diversification. Unfortunately, for some investors, the lure of big returns can influence their ability to make objective decisions.

We have seen many times when an investor will want to take more risk or give up their well-designed diversification in an attempt to increase their returns after they have lagged the S&P 500 Index as if they are in a contest with the index. Consider the following scenario:

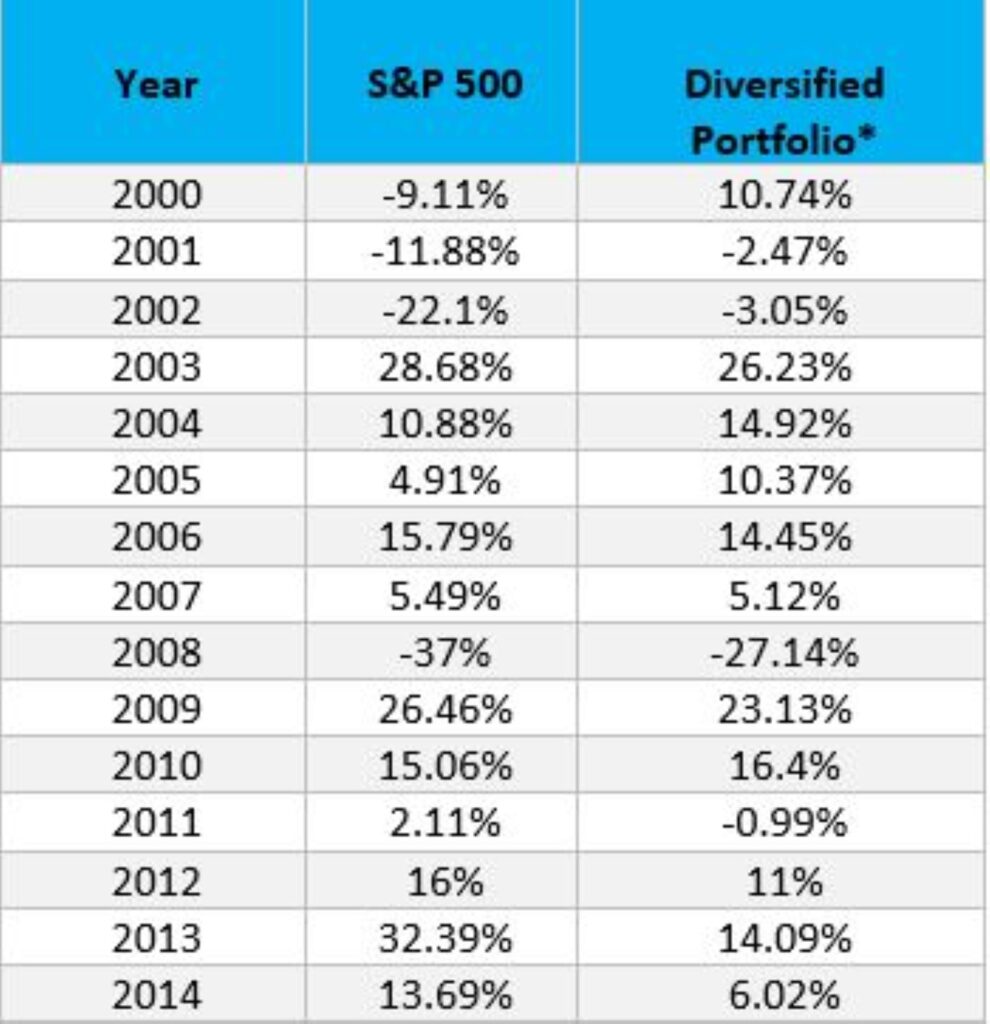

You are meeting with your financial advisor and are happy because you are coming off a good year. Your investments were up over 6% during the previous year (2014). However, your advisor goes on to show you that the S&P 500 Index was up over 13%! You inquire why your portfolio lagged the S&P 500 by 7% and your financial advisor goes on to tell you that your portfolio is diversified and is taking less risk than the S&P 500 Index. While it seems logical, you still wish you had the 13% return last year. You are asking yourself, “Does it really make sense to be diversified or should I just invest in the index?” In fact, over the past 15 years, the S&P 500 Index performed better than an eight-asset-class diversified portfolio 53% of the time (8 out of 15 years). See Figure A.

Figure A. The Annual Returns of the S&P 500 Index vs. a Diversified Portfolio

Source: Commonwealth Financial Network, Bloomberg. The diversified portfolio consists of an equal percentage invested in the following benchmarks and rebalanced annually: S&P 500 Index, S&P 400 Index, S&P 600 Index, Dow Jones US Select REIT Index, MSCI ACWI Ex US Index, Barclays Aggregate Bond Index, Dow Jones UBS Commodities Index, Cash (3-Month T-Bills). The S&P 500 Index returns include dividends and was measured on the last trading day for each of the years in the example.

Patience and Discipline are the Keys to Successful Investing

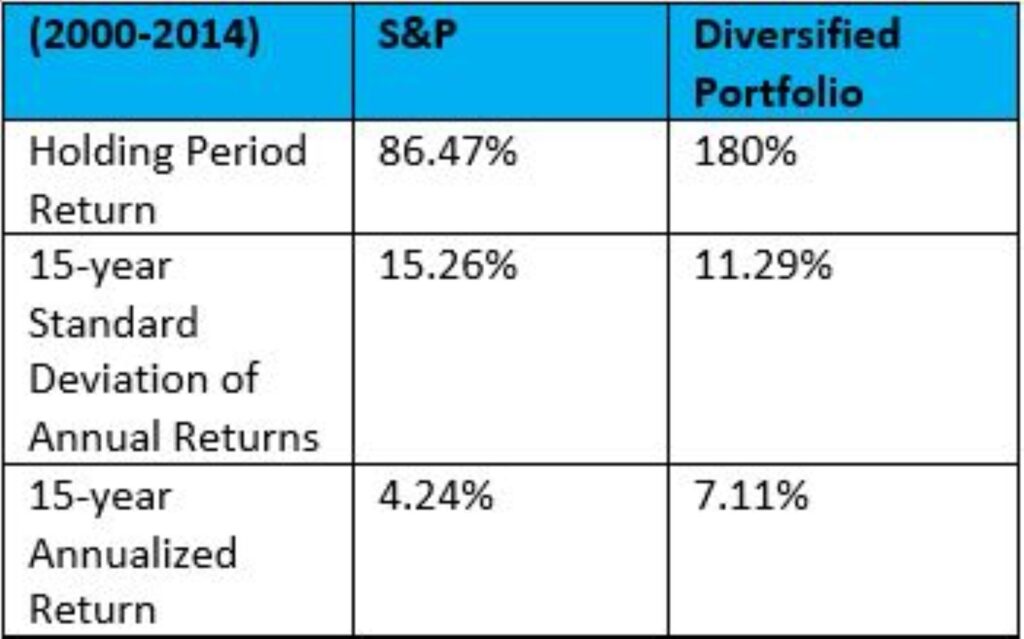

Figure B compares the average return for the S&P 500 from 2000 to 2014 to the returns from the eight-asset class (equally weighted) portfolio over the same time period, rebalanced annually.

Figure B: The Diversified Portfolio Did Better: More Return and Less Risk.

Source: Commonwealth Financial Network, Bloomberg. Assumptions: Dividends are reinvested and diversified portfolio is rebalanced annually at the end of the year. Both standard deviation and returns were based on annual figures.

Over this 15-year period, a $10,000 investment that tracks the S&P 500 Index would have grown to $18,643. However, an investor with the patience to let the S&P 500 Index perform better 53% of the time and the discipline to rebalance the portfolio, would have seen their portfolio grow to $28,019! In other words, the Diversified Portfolio performed better and with less risk, even though it lagged the S&P 500 Index 53% of the time.

Now consider that the Diversified Portfolio had 26% less risk than the S&P 500 Index (as measured by Standard Deviation) and diversification becomes more compelling.

Negative Years Hurt

Why did this happen? Negative years are disproportionally more damaging to a portfolio than a positive return of the same size. This is because, after a loss, the losing portfolio needs to work much harder to catch up. For example, consider the following:

What’s the Answer?

Sometimes, if you are in a diversified portfolio with only a portion of your investments in stocks and the stock market is in the midst of a bull market, you may feel like you’re missing the party. You may feel tempted to take more risk, most likely at the wrong time – after the market has increased. Just like having a few houses on a variety of Monopoly properties isn’t as exciting as owning a hotel on Park Place, sticking with your diversified portfolio (based on your accurately assessed risk tolerance) will likely lead to less exciting ups, but more importantly less exciting downs.

All indices are unmanaged and investors cannot actually invest directly into an index. Unlike investments, indices do not incur management fees, charges, or expenses. Past performance does not guarantee future results. Diversification does not assure a profit or protect against loss in declining markets, and diversification cannot guarantee that any objective or goal will be achieved.