Retirement Planning: Can Alternative Investments Help You Weather Volatile Markets?

April 23, 2019

When planning for retirement, you have to balance taking too much risk and too little risk with your investments. Being too conservative creates the potential risk of outliving your savings or losing purchasing power due to inflation, and, at the same time, you can’t take too much risk, since once you’re retired, there’s no easy way to make back large losses.

Historically, stocks have performed better than bonds over long periods of time which could lead an investor to overweight their portfolio to equities. But that view is short-sighted; investing all of your retirement savings into stocks would typically not be a recommended strategy due to the short-term risks of the market. Traditional investment wisdom suggests that bonds, known for their safety and stability, should be part of a retiree’s diversified portfolio. However, investors need to consider interest rate risk.

Aren’t Bonds a Safe Investment?

Bonds are usually a relatively safe investment… but not always. For example, consider interest rate risk as one of many risks that can affect bonds. When interest rates rise, bonds fall in value. Why? A bond pays a fixed interest rate – say, 3%. If interest rates rise, investors could get better than the 3% on a new bond, so your existing bond is suddenly less attractive. In other words, you can’t sell it for as much on the market. If you hold longer-term bonds, those can be especially impacted by rising rates.

We’re in a unique situation today where interest rates are at historically low levels but may increase if the economy continues to expand. At the same time, U.S. stocks have been rising for ten consecutive years. While no one knows if they will go continue to move higher, eventually a bear market is inevitable.

A Perfect Storm

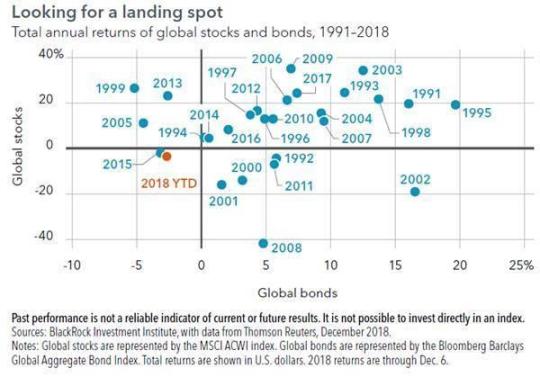

This is creating an environment where both stocks and bonds could fall together. It’s already starting on a smaller scale: in 2015 and 2018, both stocks and bonds finished down for the year. That’s only happened twice in the past 29 years! See the chart below.

If you’re in, or nearing, retirement, you might find yourself invested in a portfolio made up of only stocks and bonds. Even if you don’t think you own a lot of bonds, they might be hiding in your retirement account if you own balanced mutual funds or target-date funds. This classic stock/bond allocation may be setting investors up for some financial pain in the future.

Of course, it’s difficult to think about losses right now after ten years of positive returns for equities. But if you think back to the bear market that started in 2008, when mostly everyone experienced substantial losses, you’ll probably recall some very uncomfortable feelings. Those with time on their side were able to ride it out, but there were also people forced to delay their retirement.

Stress Testing Your Financial Future

That is why financial planning is critical, especially for those nearing retirement. Financial planning helps you look out into the future at various possible outcomes so you’re prepared, not surprised. However, financial planning is only one half of the equation; the other half is stress-testing your investments.

It is important to regularly stress-test your portfolio to make sure even the worst of these various outcomes are in line with what your personality may be able to tolerate. For those with decades ahead of them and increased income potential, holding through the next bear market may be tolerable. However, if you are in or approaching retirement, it can make a sustained downturn can have a devastating effect.

As financial planners who specialize in retirement planning, we believe there is one often-ignored ingredient that can help. That’s the careful addition of alternative investments to your investment portfolio.

What’s an Alternative Investment?

The term “alternative investments” actually covers a wide variety of investments. These can include commodities (like gold or silver), art, real estate, private equity, and venture capital (which we’ve previously written about).

Purpose of Alternatives

What do the diverse investments under this category have in common? First, they don’t normally move in the same direction as stocks and bonds. In financial lingo, they are “non-correlated” which means when stocks and bonds go down, you’ll often find these rising or staying flat. And vice versa. But, they could move in the same direction – that’s the beauty of non-correlated investments.

By acting as a diversifier, alternative investments can help protect your portfolio. When your stocks and bonds are falling, alternative investments may be increasing. They can serve to help offset your losses in down years, smoothing out your overall returns.

History of Alternative Investments

In the past, only large institutional investors, such as pensions and endowments, were able to use alternatives because of the cost, illiquidity, and high minimum investment involved. However, over the past decade, the financial services industry has developed many ways to invest in alternative strategies through the use of mutual funds, fund-of-funds, and other products. For example, “long/short funds” are mutual funds that can buy stocks “long” that they think will increase in value while also betting against or “shorting stocks” they think may fall in value.

What’s the Downside?

With market volatility increasing in 2018, and interest rates potentially moving higher, alternative investments may be an appropriate part of a diversified portfolio.

As with any investment, there many considerations involved with alternative investments. Some things to consider include:

- Due diligence. You don’t hear as much about buying alternative investments as you do stocks or bonds. There’s certainly fewer of these than the traditional financial products, therefore you shouldn’t follow the same process as when investing in an index fund. These investments require significant research, both before buying and on an ongoing basis.

- Patience. As with any investment, you can’t expect instant results. You’ve got to give it time.

- Less liquid. Investments are said to be “liquid” when we can buy and sell them quickly. Stocks and bonds can typically be sold within seconds in today’s market; that makes them a highly liquid investment. Some alternative investments, on the other hand, may not always be as liquid.

- Higher transaction costs. Because of their specialization, most alternative investments carry higher fees than traditional funds and ETFs.

Are Alternatives Right for You?

Because of these increased costs, potential illiquidity and sometimes complicated strategy, alternatives should be selected carefully based on your investment goals. In our 25 years of serving our retirement-age clients, we believe some exposure to alternatives such as real estate, private equity, venture capital, or long/short strategies, among others, should be considered.

While there are no guarantees, alternatives may help you reduce your risks if used carefully. Work with your financial advisor to deploy them thoughtfully, and you might find yourself sleeping more soundly at night, whatever the market is doing.

Investing in alternative investments may not be suitable for all investors and involves special risks, such as risk associated with leveraging the investment, utilizing complex financial derivatives, adverse market forces, regulatory and tax code changes, and illiquidity. There is no assurance that the investment objective will be attained.

Let the Certified Financial Planner® professionals at Williams Asset Management help with your wealth management needs. Whether you need comprehensive and holistic financial planning or investment management, we can help! We are fee-based, independent financial advisors located in Columbia, the heart of Howard County, Maryland. Schedule your complimentary consultation today by calling (410) 740-0220!