Managing Health Care Costs in Retirement

September 10, 2025

Presented by: Brian McKinney, CFP®

For many retirees and those approaching retirement, health care is one of the biggest financial concerns. Medicare offers a valuable foundation, but it doesn’t cover everything. From routine doctor visits to long-term care, understanding your options and planning ahead can help you manage costs, protect your savings, and reduce stress. This guide outlines what you need to know to take control of your health care expenses in retirement.

Understanding Medicare and Other Insurance Options

After you retire, you’ll most likely move away from employer-sponsored health insurance. For most people, Medicare becomes the primary source of coverage starting the month you turn 65. But it’s important to understand what Medicare includes—and what it doesn’t. Be sure to enroll on time—delays in signing up for Medicare Parts B or D can lead to permanent late penalties.

Medicare is made up of several parts:

- Part A covers hospital stays and is typically free if you paid Medicare taxes while working.

- Part B covers doctor visits, outpatient care, and preventive services. It comes with a monthly premium.

- Part D helps cover prescription drugs and requires enrolling in a separate plan or choosing a Medicare Advantage plan that includes it.

- Medicare Advantage (Part C) is an alternative to Original Medicare. These plans are offered by private insurers and bundle Parts A and B—and often Part D—along with additional benefits such as dental, vision, hearing, and wellness programs. However, they typically require you to use a network of providers and may have different rules around referrals or out-of-pocket costs.

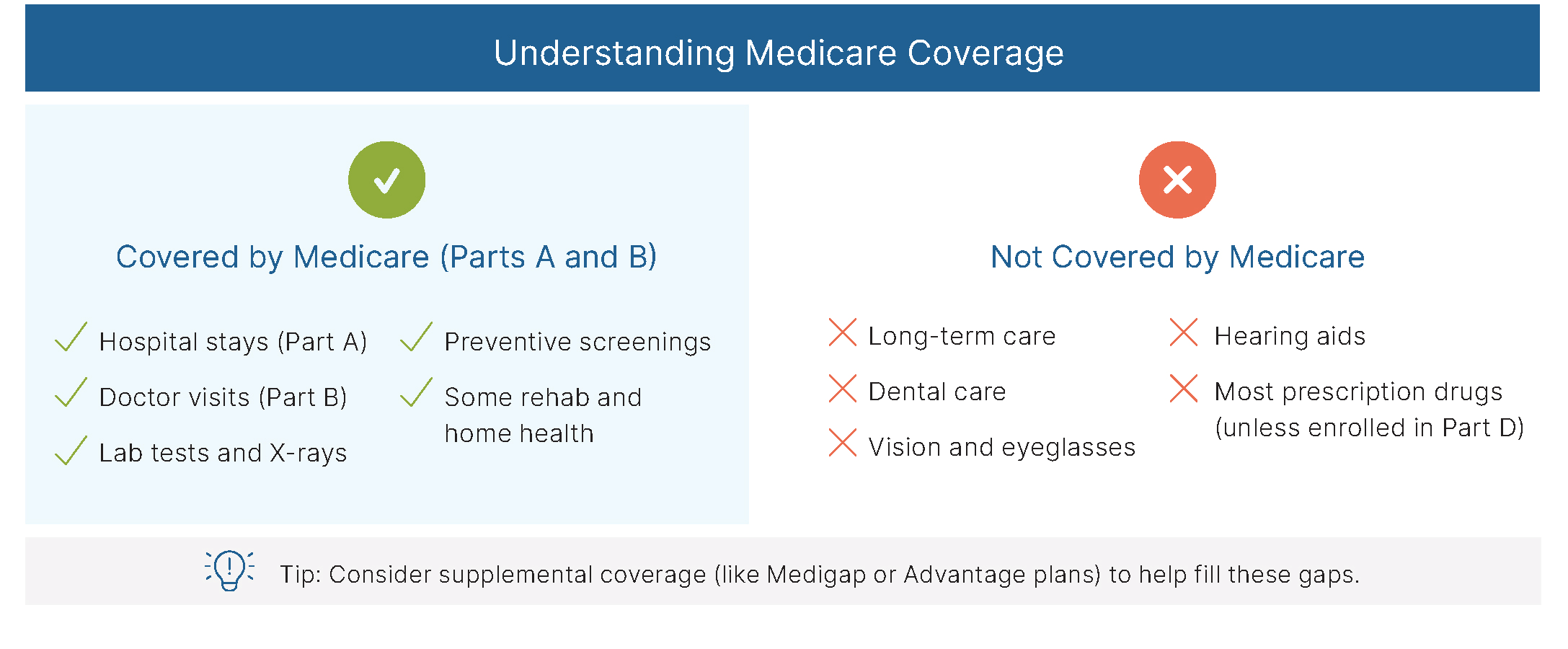

Original Medicare (Parts A and B) doesn’t cover everything. It excludes routine dental care, eye exams, hearing aids, and most long-term care services. You’re also responsible for paying deductibles and a portion of service costs. To help with these expenses, you can consider either a Medigap (Medicare Supplement) policy or a Medicare Advantage plan:

- Medigap plans work alongside Original Medicare to help pay your share of covered services—like copayments, coinsurance, and deductibles. These plans don’t include drug coverage, so you’d need a separate Part D plan. You have a guaranteed issue right—which means insurers must offer you coverage without considering your health history—to buy a Medigap policy within the first six months of enrolling in Part B at age 65 or older.

- Medicare Advantage plans replace Original Medicare entirely, offering all-in-one coverage. They often come with added perks but may limit which doctors or hospitals you can use.

If you retire before age 65, you won’t yet qualify for Medicare. In that case, you can look for coverage through the Health Insurance Marketplace or extend your employer plan through COBRA, though COBRA can be costly and typically only lasts up to 18 months, which may not fully bridge the gap to Medicare eligibility. Some retirees also have access to retiree health benefits from their former employers or work with a financial advisor to coordinate individual health insurance coverage.

For retirees with limited income and resources, Medicaid may provide additional help. This joint federal and state program offers broader coverage, including long-term care services that Medicare does not. Because eligibility and benefits vary by state, some people may need to reduce their assets to qualify. Speaking with a financial advisor or elder law attorney can be helpful if you think Medicaid might be part of your future health care plan.

Reducing Out-of-Pocket Health Care Expenses

Even with good insurance, retirement health care costs such as premiums, deductibles, and copays can add up quickly. The good news is there are practical ways to reduce those expenses:

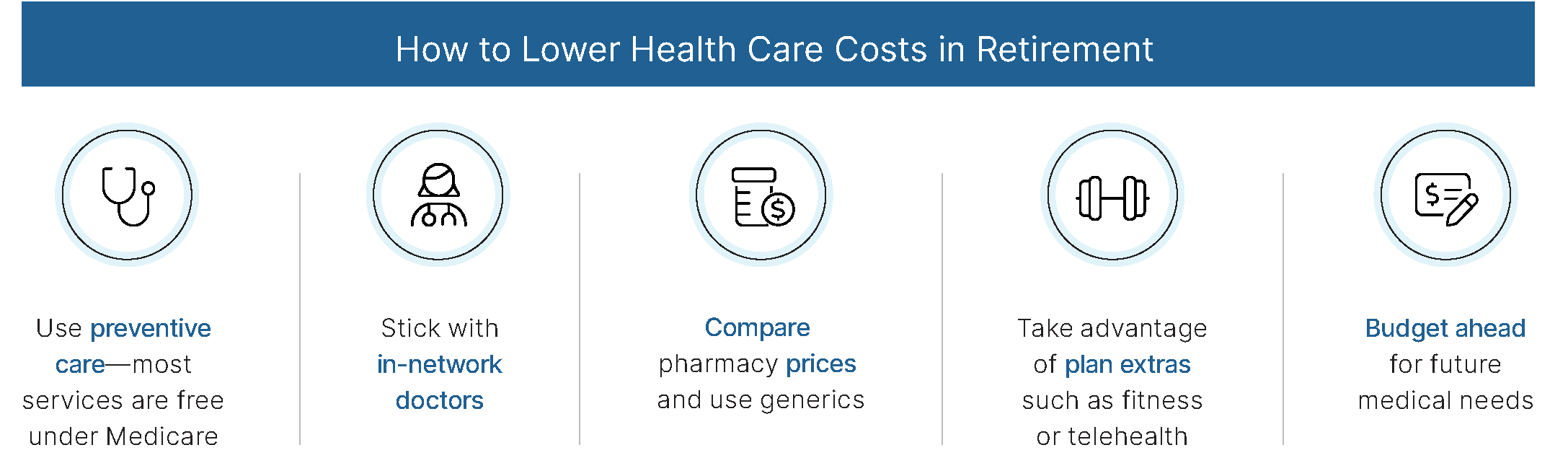

- Use preventive care benefits: Medicare covers many preventive services, such as annual wellness exams, cancer screenings, and vaccines, at no cost. These can help catch health issues early and prevent costly complications.

- Stick with in-network providers: If you’re in a Medicare Advantage plan or have supplemental insurance, using in-network doctors and facilities can save you from higher fees and unexpected bills.

- Be smart about prescriptions: Medication prices vary widely. Compare pharmacy prices, look into generic alternatives, and make sure your prescriptions are covered by your plan’s formulary (preferred drug list).

- Take advantage of extra benefits: Some Medicare Advantage plans offer perks such as gym memberships, telehealth visits, and disease management programs. These extras can promote wellness and help you avoid more expensive care later.

- Include health care in your budget: Be sure to set aside funds for medical costs in your retirement budget. If you have a Health Savings Account (HSA) from when you were working and enrolled in a high-deductible health plan, you can use those funds tax-free for qualified medical expenses. Once you’re enrolled in any part of Medicare—including Part A—you can no longer contribute to an HSA. However, any money already in the account remains yours to use throughout retirement.

By combining smart insurance choices with proactive health management, you can lower your health care expenses and gain peace of mind.

Don’t Overlook Long-Term Care

Long-term care refers to help with everyday activities such as bathing, dressing, or eating—whether at home, in assisted living, or in a nursing home. Many people will need this kind of care at some point, but Medicare doesn’t cover most of it.

Without proper planning, these services can be costly and may quickly drain retirement savings. Some people choose to pay from personal savings or income, while others purchase long-term care insurance—ideally in their 50s or early 60s, when premiums are more affordable and qualifying is easier. Health status also plays a major role in eligibility, so applying earlier—before serious health conditions arise—can improve your chances. For those with limited resources, planning ahead for Medicaid eligibility may be a viable option. A financial advisor can help you weigh these choices and prepare a strategy that fits your situation.

By understanding your health care coverage options, planning for additional expenses like long-term care, and using strategies to reduce costs, you can protect your financial security and make the most of your retirement years. If you’re unsure how to tailor a plan to your needs, a trusted financial advisor can help guide you—clearly and without jargon.