Is there an AI bubble?

November 24, 2025

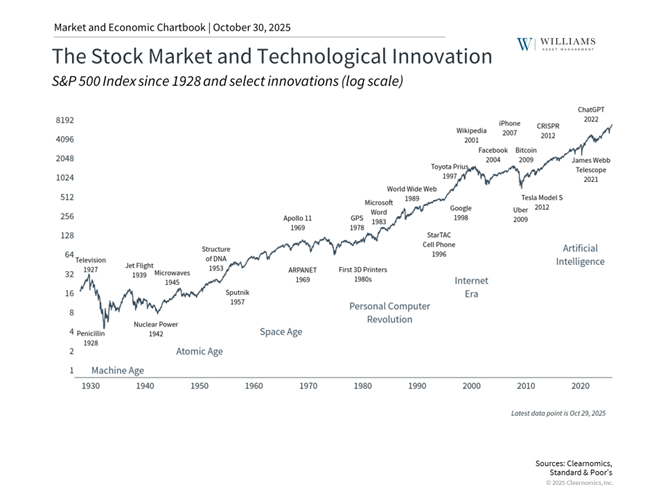

With artificial intelligence all over the financial headlines and the stock market reaching new highs, some investors are wondering if we’re experiencing another bubble similar to the dot-com era. It’s a fair question, and one we take seriously, especially given the high valuations and the enormous sums being invested in AI infrastructure.

I want to address these concerns directly and explain how we’re thinking about AI investments in the context of your long-term financial plan. The key is to position your portfolio to benefit from innovation while managing risk appropriately.

The spending by large companies on AI projects is easily in the trillions of dollars. This includes building new data centers, buying equipment such as GPUs, and hiring AI researchers.

Some of these investments involve deals that seem circular. For example, Nvidia invested up to $100 billion in OpenAI, which in turn is buying millions of Nvidia’s chips. These interconnected relationships have raised concerns about whether the AI ecosystem can sustain itself if enthusiasm wanes.

These trends reflect the reality that AI requires infrastructure that few companies can afford alone. The question is whether the technology will ultimately generate enough value to justify the spending. As it stands, AI investment is currently a large contributor to the overall economy (GDP growth).

It may seem academic, but distinguishing between healthy growth and a bubble is difficult while it’s happening. In hindsight, the dot-com bubble is obvious – companies with no revenue were valued in the billions. But not everything that drives markets higher turns out to be a bubble.

Consider cloud computing – the technology that now powers the web. A decade ago, some investors worried that spending on cloud infrastructure was excessive. Today, these technologies are fundamental to how businesses operate.

One key difference is that many of today’s AI leaders are profitable, established companies with strong balance sheets. These include the so-called “Magnificent 7” companies including Google, Meta, Microsoft, and more.

Even when we agree something was a bubble in hindsight, the underlying technology may still be transformative. The dot-com bubble of the late 1990s is a helpful example: investors at the time overestimated how quickly it would generate profits. Yet, the internet did transform the economy and our daily lives – we can’t imagine a world without it now.

The companies that survived, including Amazon which lost 95% of its value during the crash, went on to become some of the most valuable businesses in history. So, this is not to say we may not see market swings in the meantime. Instead, these historical examples are a reminder that we should take a longer-term view.

We can likely all agree that what AI can do today is already remarkable. For many investors and business leaders, the hope is that AI will drive significant productivity improvements. This is the essence of innovation and economic growth.

History shows that productivity gains from new technologies don’t happen overnight. It takes time for new technologies to gain widespread adoption, particularly among businesses that must reorganize their operations to benefit.

The railroad boom of the 1800s, the electrification of the early 1900s, the “tronics” wave of the mid-20th century, and the internet revolution of the 1990s all followed similar patterns. Initial enthusiasm drove investment and rising stock prices. Eventually, reality caught up, and markets corrected as investors realized the technology would take longer to generate returns than anticipated. Yet all of these innovations fundamentally transformed the economy.

The question is whether current valuations properly reflect the timeline and magnitude of returns. With the S&P 500 trading at a price-to-earnings ratio of over 22.5x, approaching its all-time high of 24.5x, markets are pricing in significant future growth.

Related to your financial plan, the key is the following:

- We design your portfolio to benefit from technological innovation over the long term while also meeting your other financial needs, including generating income and managing risk.

- This means maintaining appropriate diversification across sectors, company sizes, and asset classes. While technology stocks may continue to perform well, having too much exposure to any single area creates “concentration risk.” Even great companies and transformative technologies can experience periods of significant underperformance.

- Your portfolio is positioned to participate in opportunities while also prudently diversifying your portfolio. This approach won’t capture every penny of upside during strong rallies, but it’s designed to weather changing market conditions and keep you on track toward your financial goals.

AI represents a genuine technological revolution that will likely transform the economy over time. However, the path from here to there may be more volatile and take longer than current market enthusiasm suggests. Rather than trying to predict whether this is a bubble, we encourage you to focus on maintaining a long-term view to benefit from innovation while managing risks.

As always, we are here to discuss how these developments affect your specific situation and financial plan. Please don’t hesitate to reach out with any questions or concerns.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

Advisory services offered through Commonwealth Financial Network®, a Registered Investment Adviser.