How to Choose Between Buying and Leasing a Car

November 11, 2025

Presented by: Brian Modarress

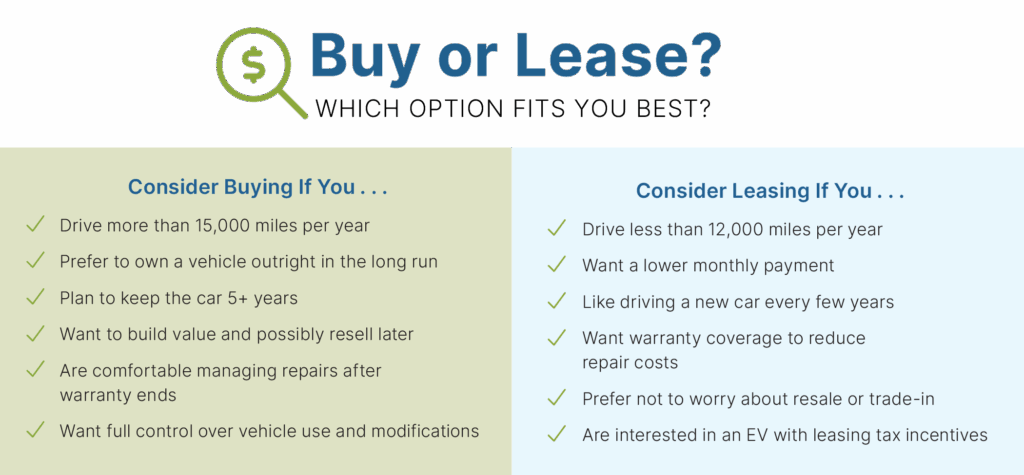

For anyone in the market for a vehicle, one of the most important financial decisions to make is whether to lease or buy. It’s not just about preference; it’s about cost, flexibility, and how a vehicle fits into your broader financial goals. With current car prices still elevated, interest rates higher than usual, and many people driving less due to remote or hybrid work, this decision carries even more weight than it did a few years ago.

Both leasing and buying offer legitimate advantages, and neither is inherently “better” across the board. The key is understanding how each works, what they cost over time, and which option best fits your driving habits and financial situation.

Buying a Car

When someone buys a vehicle—either outright or through financing—they are paying to eventually own the car completely. Once the loan is paid off, there are no more monthly payments, and the vehicle can be kept, sold, or traded in as desired. For drivers who plan to keep a vehicle for many years, this can result in significant long-term savings.

Ownership offers flexibility. Drivers are free to put as many miles on the vehicle as they want, make modifications, and manage wear and tear without worrying about contract terms. However, new vehicles lose value quickly, by 20 percent to 30 percent in the first year, and once a warranty expires, repair costs typically rise. For those concerned about depreciation or maintenance, buying a certified pre-owned car, a used vehicle that has passed a thorough inspection and comes with an extended warranty, can be a smart middle ground.

Leasing a Car

Leasing is essentially a long-term rental. The driver pays for the use of the car over a set period (usually two to four years) and returns it at the end of the lease. Monthly payments are typically lower than those for a loan on the same car, and upfront costs, like a down payment and sales tax, are often reduced.

Leasing may also appeal to those who want to drive newer vehicles with the latest technology and safety features without worrying about long-term reliability. Most leases also include warranty coverage for the full term, which lowers repair expenses. But there are limits: leases often cap annual mileage at 10,000 to 15,000 miles, and going over can result in costly penalties. Lessees must also return the vehicle in good condition or risk end-of-lease fees.

Because a leased car is never owned, there’s no resale value at the end—and no chance to recover any of the money paid. It’s important to consider that the lower monthly payments come with trade-offs in flexibility and long-term value.

What to Consider in Today’s Climate

Several current market conditions are affecting how buyers and lessees should approach this decision:

- High car prices remain a reality, especially for new vehicles. While prices have eased slightly compared to pandemic peaks, many models are still significantly more expensive than they were five years ago.

- Interest rates for car loans now average between 6 percent and 8 percent for borrowers with good credit, increasing the total cost of financing. Leasing rates—calculated using a factor called the “money factor,” which functions like an interest rate—are also elevated, though they can be slightly lower than loan rates.

- Remote and hybrid work continue to reduce the time and miles many people drive. This makes leasing more practical for some drivers who now put fewer miles on their car and can stay well within the lease’s mileage limits.

- Electric vehicle (EV) incentives may favor leasing. Certain federal tax credits are currently easier to access through a lease than a purchase, as dealers can apply the credit to reduce lease costs directly.

Look at the Bigger Financial Picture

There’s no single right answer when it comes to leasing versus buying—it depends on the driver’s needs, habits, and financial priorities. Someone who commutes long distances, plans to keep a vehicle for many years, or wants to avoid recurring payments may find that buying offers better value over time. On the other hand, someone who drives less, prefers newer cars with updated features, or wants predictable costs and minimal maintenance might benefit from leasing.

The smartest choice is the one that aligns with a household’s broader financial goals. That includes not just the monthly payment, but the total cost over five to seven years: insurance, maintenance, fuel or charging, taxes, and potential resale value. A decision based only on what feels affordable month-to-month may miss hidden long-term costs.

When possible, it’s wise to run a full cost comparison before deciding—and to treat the car not just as a vehicle but as part of a larger financial plan.

Williams Asset Management and Commonwealth Financial Network® do not provide legal or tax advice. This material has been provided for general informational purposes only and does not constitute either investment or tax advice. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a financial advisor or tax preparer.