How Does the Stock Market Fare During Election Years?

December 30, 2019

As the 2020 presidential election approaches, publications and news broadcasts alike are ramping up their coverage of polling updates and speculating on what effects the outcome of the upcoming election could have on the state of the stock market.

Let’s take a look at some historical numbers to see if we can filter through some of this noise.

In turn, all of this “forecasting” is causing investors to feel more nervous than ever. We see this first-hand, as most of our clients in their review meetings want to discuss at length the upcoming election and how it could potentially impact their retirement nest egg, whether it be for better (invest more aggressively) or for worse (move everything to cash).

Republican or Democratic Party: Which is Better for Your Investments?

Your political view may lean strongly toward one party or the other, but when it comes to protecting your portfolio, it historically has mattered little which party controls the White House. Conventional wisdom might suggest that the Republican Party, which is supposedly more business-friendly than the Democratic Party, would be more beneficial for your investments. However, looking way back to 1900, Democratic presidents have had a more significant positive impact on stocks, with the Dow up an average of nearly 9% annually, compared with nearly 6% per year during Republican administrations (Kiplinger).

The Correlation between the Stock Market and the Presidential Cycle

A potentially reckless notion that a lot of investors have is that the U.S. stock market will have above-average returns in the year of a presidential election, especially one in which a first-term president is up for reelection. While this viewpoint does make intuitive sense—any president who wants to be reelected will go to great lengths to make sure the economy and the stock market are roaring come Election Day—history does not support it.

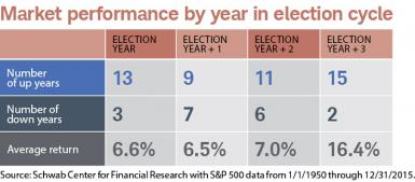

As you can see on the chart below, on average, the best year for the stock market is the third year of the four-year presidential cycle. The election-year itself tends to be below average for equities. This can be attributed to uncertainty; investors and the markets alike despise uncertainty.

Another important factor to consider is the strength of the economy at the time of the election. As it turns out, the strength of the economy is likely more important than the state of the stock market in determining a president’s reelection chances. Out of the thirteen times a president has been up for reelection going back to 1928, there were only three times when the incumbent lost the presidency. Each of those instances came just after a recession (Fortune).

Do Campaign Promises Actually Impact the Stock Market?

In addition, investors often place too much weight on how a potential candidate’s campaign promises will affect the economy. It’s often overlooked just how difficult it will be for the new president to deliver on their platform’s main promises. The next president will have a very difficult time passing controversial overhauls on tax laws or business matters through a split Congress like the one we have in 2019. While the president does have extensive power, there is a lot they cannot do without congressional approval. The president has a big impact on foreign policy and trade, whereas Congress ultimately controls taxes, laws affecting business, and other issues of interest to investors.

Don’t Let Election Years Derail Your Long-Term Goals

In conclusion, election years often spark fear in investors’ minds as election rhetoric amplifies the country’s issues. However, consider the fact that investment success has depended more on the strength and resilience of the American economy rather than on which candidate or party holds the Oval Office. While it’s still important to consider who the president will be, it’s potentially more important to consider the current state of the economy, which can be gauged by looking at recent GDP and consumer confidence numbers.

In other words, political biases can blind you to the other fundamental forces that are driving the stock market. Understanding how these forces impact investor sentiment and demand for stocks is important. Investors often think they have found a pattern or trend to capitalize on come election time, but in reality, making emotional portfolio decisions based solely on election results could negatively affect your portfolio. Investors who look beyond the headlines, focus on long-term goals, and avoid trying to time the market have reaped the rewards in the long run. Or as noted economist Paul Samuelson said: “Investing should be more like watching paint dry or watching grass grow. If you want excitement … go to Las Vegas.”

Let the CERTIFIED FINANCIAL PLANNER® professionals at Williams Asset Management help with your wealth management needs. Whether you need comprehensive and holistic financial planning or investment management, we can help! We are fee-based, independent financial advisors located in Columbia, the heart of Howard County, Maryland. Schedule your complimentary consultation today by calling (410) 740-0220!

Share on social media