Emotions and Investing: Keep Your Poker Face

February 5, 2019

We all know it’s natural for the market to go up and down. But when you have hard-earned cash invested in that market, those ups and downs can sometimes weigh heavily on your emotions. The downs can cause stress, self-doubt, and more importantly, a smaller investment account. While the ups can sometimes make you feel smart, wealthy, and confident. The successful investor knows how to handle his or her emotions when dealing with a prolonged bull market or when the inevitable happens and she is stuck in what seems like a never ending bear market.

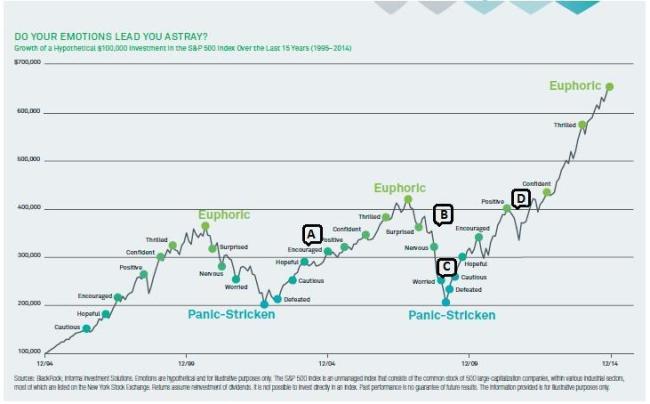

The chart below shows how the inevitable fluctuations in the market can affect your emotions. When you realize what causes one of these stages, it becomes easier to avoid the stress of the different emotions surrounding the cycle.

The Stages of the Investing Cycle

In Stage A, investors see the market rising and are eager to take advantage of the opportunity. The nervousness and panic from the previous market correction are a distant memory. Most of the noise from the media is likely touting that the bull market’s end is not in sight, giving the investor confidence. Sometimes this may lead to investing beyond the investor’s risk capacity.

Stage B sees investors watching the decline, becoming anxious about how much farther it will go, and wondering whether they still want to be at the party. There is much stress and second-guessing in this stage. They are worried but still hopeful the downturn is just a short-term blip in the market. While there is a little nervousness, they are still in “the black” and are not considering any changes to their risk tolerance.

In Stage C, investors have likely seen much or all of their gains evaporate. They are in panic mode and unsure of what to do. The discerning investor is taking advantage of this opportunity to buy stocks at a low price but the novice investor or the emotionally-drained investor is thinking about throwing in the towel and pulling out of the market.

Finally the tide changes and the markets enter Stage D. Ah…. Relief. The pain has subsided and the market meltdown becomes ancient history. While some will be scared from the downturn, others will forget it happened and become excited about the opportunities in the market. Only when investors become euphoric does the market peak. How do you know euphoria is in the air? When you start to hear your hair dresser telling you about a hot stock or the grocery cashier telling you about the stock of a food product you just purchased, then you know the end is near.

So, how do you avoid this emotional rollercoaster? My suggestion is twofold: put on your “poker face” and diversify your investments. The best poker players have a stoic expression on their face at all times. They don’t start giggling when they are sitting on a Royal Flush nor do they shed tears when they are dealt a bad hand. In other words, stay unemotional with your money and your investments. I know this is easy to say and hard to do but hopefully, this blog will serve as a reminder. Secondly, diversify your portfolio’s investments prudently based on cost, correlation metrics, risk-adjusted returns, and asset class exposure that are appropriate for your overall risk tolerance.

Diversification does not assure a profit or protect against loss in declining markets, and diversification cannot guarantee that any objective or goal will be achieved.