Chasing Returns – the Biggest Mistake Investors Make

February 27, 2019

For anyone who has either played or watched a game of baseball, hitting that big home run is exciting. This can be compared to investing all your money into an investment that tracks the S&P 500 Index and having a year like 2013 when your portfolio was up over 32%.

America’s favorite pastime, baseball, can teach an investor a great deal about investing than one would originally believe. In the game of baseball, batters go for singles, doubles, triples, and even home runs, while the pitchers are throwing deceiving pitches trying to throw off the batters. One strategy is to swing for the fences on every pitch and try for the home run. A different approach is to play it safe and land a bunch of singles and doubles to win the game in a more consistent manner.

For anyone who has either played or watched a game of baseball, hitting that big home run is exciting. This can be compared to investing all your money into an investment that tracks the S&P 500 Index and having a year like 2013 when your portfolio was up over 32%. On the other hand, the team that focuses on the less exciting walk, single, or double, may also have a very good chance of winning the game, if not better. If you are following along with our metaphor, we hope to show you that the latter approach is the better way to “win the game” of investing. Let’s go though some data that will illustrate, historically speaking, that investing in a diversified portfolio, that is “singles” and “doubles”, could help you accomplish your goals more efficiently then by simply investing in the S&P 500 Index.

Chasing Returns

As investment advisors with a combined 27 years’ experience, we value and understand the benefits of diversification. Unfortunately, for some investors, the lure of big returns can influence their ability to make objective decisions. Think back to the home run analogy. The excitement of hitting that home run is appealing, but realistically leads to more strikeouts. We have seen many times when an investor will want to take more risk or give up their well-designed diversification in an attempt to increase their returns after they have lagged the S&P 500 Index, as if they are in a contest with the index. Consider the following scenario:

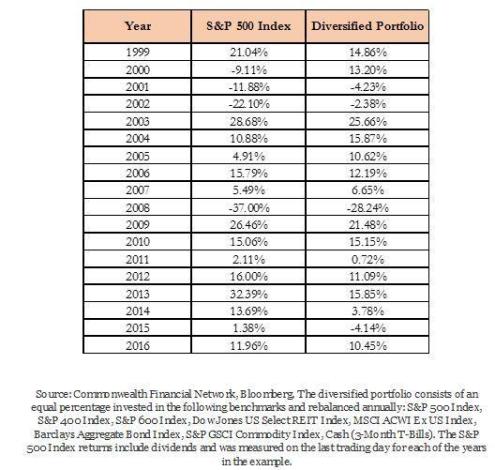

You are meeting with your financial advisor and are happy because you are coming off a good year. Your investments were up at 10% during the previous year (2016). However, your advisor goes on to show you that the S&P 500 Index was up at 12%! You inquire why your portfolio lagged the S&P 500, and your financial advisor goes on to tell you that your portfolio is diversified and is taking less risk then the S&P 500 Index. While it seems logical you still wish you had the 12% return last year. You are asking yourself, “Does it really make sense to be diversified or should I just invest in the index”? In fact, over the past 18 years, the S&P 500 Index performed better than an eight-asset-class diversified portfolio 56% of the time (10 out of 18 years). See Figure A.

Figure A. The annual returns of the S&P 500 Index vs. a diversified portfolio

Patience and Discipline are the Keys to Successful Investing

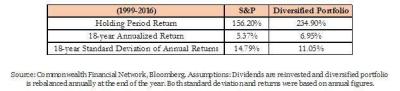

Figure B compares the average return for the S&P 500 from 1999 to 2016 to the returns from the eight-asset class (equally weighted) diversified portfolio over the same time period, rebalanced annually. See Figure B.

Figure B: The Diversified Portfolio did better: More return and less risk

Over this 15-year period, a $10,000 investment that tracks the S&P 500 Index would have grown to $25,620. However, an investor in the “Diversified Portfolio”, with the patience to let the S&P 500 Index perform better 56% of the time and the discipline to rebalance the portfolio, would have seen their portfolio grow to $33,490! In other words, the Diversified Portfolio performed better, with less risk, even though it lagged the S&P 500 Index 56% of the time.

Now consider that the Diversified Portfolio had 25% (as measured by Standard Deviation) less risk then the S&P 500 Index and diversification becomes more compelling.

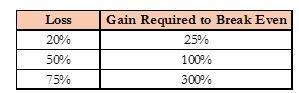

Negative Years Hurt

Why did this happen? Negative years are disproportionally more damaging to a portfolio then a positive return of the same size. This is because after a loss, the losing portfolio needs to work much harder to catch up. For example, consider the following:

What’s the Answer?

Sometimes, if you are in a diversified portfolio with only a portion of your investments in stocks and the stock market is in the midst of a bull market, you may feel like you are missing the party. You may feel tempted to take more risk, most likely at the wrong time – after the market has increased. Sticking with your diversified portfolio, based on your accurately assessed risk tolerance, will likely lead to less exciting ups, but more importantly less exciting downs.

*All indices are unmanaged and investors cannot actually invest directly into an index. Unlike investments, indices do not incur management fees, charges, or expenses. Past performance does not guarantee future results.

*Diversification does not assure a profit or protect against loss in declining markets, and diversification cannot guarantee that any objective or goal will be achieved.

Let the Certified Financial Planner® professionals at Williams Asset Management help with your wealth management needs. Whether you need comprehensive and holistic financial planning or investment management, we can help! We are fee-based, independent financial advisors located in Columbia, the heart of Howard County, Maryland. Schedule your complimentary consultation today by calling (410) 740-0220!