The “Healthy” Retirement Strategy You May Not Have Heard of

February 27, 2019

The popularity of Health Savings Accounts (most commonly referred to as HSAs) has continued to increase with changes in the health care marketplace and rising medical costs. Not only do HSAs help Americans with high-deductible insurance plans cover current out-of-pocket healthcare costs, but their potential growth and tax advantages can also help accumulate resources for future medical expenses during retirement.

HOW AN HSA CAN HELP WITH HEALTH CARE DURING YOUR RETIREMENT

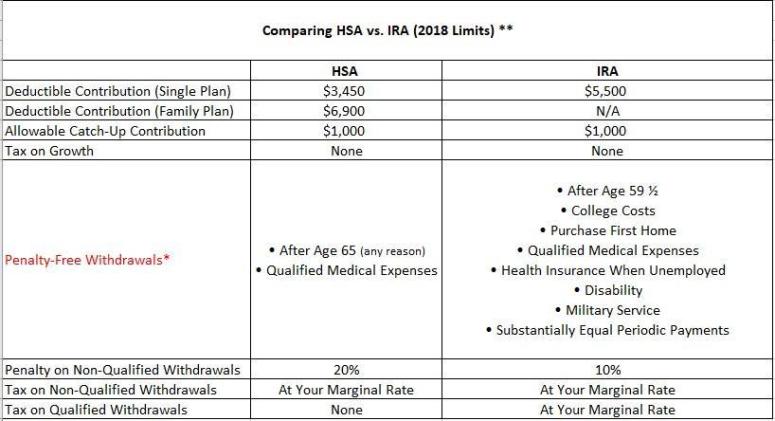

Traditional Individual Retirement Accounts (IRAs) tend to be one of the most discussed retirement planning tools—and for good reason. Contributions to an IRA may be tax deductible (assuming certain eligibility requirements) and growth in the value of its assets are tax-deferred. HSAs, however, share both of these tax advantages plusone additional valuable feature; they can also be tax-free when you withdrawal funds.

Conversely, withdrawals from an IRA are considered taxable income. Further, if you withdraw money before age 59 ½, you’ll also pay a 10% penalty (unless you meet the IRA requirements for a penalty free withdrawal). In contrast, withdrawals from an HSA to pay medical bills are not subject to income taxes or a penalty no matter your age. In other words, an HSA is triple tax exempt! You get a tax break for your contributions, growth of the HSA’s value isn’t subject to income tax, and withdrawals for qualified medical expenses are also tax and penalty free.

Other benefits include contributions to an HSA are not “use it or lose it” and are portable regardless of your employment situation. Also, if you are on a family plan, you can (based on 2018 limits) contribute more to your HSA then your IRA! HSAs have one more bonus. After you reach age 65, any withdrawals from your HSA are penalty-free. So, you can use the money in the account for any reason and simply pay taxes on the withdrawals (just as if they came out of an IRA).

PLANNING STRATEGY – LEVERAGE YOUR HSA

Since medical expenses are one of the largest expenditures of retired Americans, having an HSA nest egg can be a versatile planning tool for your retirement. If you are eligible to contribute to an HSA and you have positive cash flow, you should consider contributing the maximum allowable amount each year to your HSA. Then, when you retire, you can use your HSA to pay your qualified medical expenses instead of withdrawing those funds from your IRA. Remember that Social Security income may be taxable and that Medicare premiums are based on your modified adjusted gross income (or MAGI). Therefore, withdrawals from an IRA—even those spent on medical expenses—can increase your income tax liability and possibly cause higher Medicare Part B and Part D premiums.

Yet another bonus—HSAs do not have required minimum distributions (RMDs) at age 70 ½ like an IRA. Which means the IRS does not mandate that you take money out at any certain time, and your HSA can continue to grow, even past age 70 ½.

WHERE & HOW TO GET AN HSA

Eligibility for an HSA depends upon your health insurance. You must have a high deductible health insurance plan which is defined as a health plan with an annual deductible that is not less than $1,350 for self-only coverage or $2,700 for family coverage, and the annual out-of-pocket expenses (deductibles, co-payments, and other amounts, but not premiums) do not exceed $6,650 for self-only coverage or $13,300 for family coverage

Most employers that offer high deductible health insurance plans have an HSA option. If your employer offers an HSA, then their contributions to it are made with pre-tax dollars. And you can contribute additional money to that plan as long as total funding remains within contribution limits. You can also set up a plan on your own. If you do, then those contributions are tax deductible. (Again, subject to the annual contribution limit). If your employer doesn’t offer an HSA—or if you’re self-employed—you can open an HSA at a bank, brokerage firm, or other provider.

OTHER CONSIDERATIONS

As noted earlier, many providers offer HSAs. The subtle differences between them are cost and available account features. Some financial institutions offer debit cards, online banking, or various investment options. Expect the fees associated with your HSA to be commensurate with the various features you require. If your employer does not offer an HSA, you’ll have to do some comparison shopping.

As with any major financial decision, it’s always best to have a discussion with your financial advisor, educate yourself, and weigh the pros and cons of any retirement savings strategy before making a decision.

Let the Certified Financial Planner® professionals at Williams Asset Management help with your wealth management needs. Whether you need comprehensive and holistic financial planning or investment management, we can help! We are fee-based, independent financial advisors located in Columbia, the heart of Howard County, Maryland. Schedule your complimentary consultation today by calling (410) 740-0220!

*The specific details of each penalty-free withdrawal are defined by the IRS. Please consult your tax accountant or financial advisor for further clarification.

** Source: IRS