RISKS AND REWARDS: INVESTING IN VENTURE CAPITAL

By Gary S. Williams, CFP®, CRPC®, AIF® and Nicholas A. Ibello, CFP®, AIF®

Originally posted in the Baltimore Business Journal: February 1, 2019

Venture capital (VC) is one of the best-known alternative investment classes. Whether we are ordering an Uber, staying in an Airbnb, riding a Peloton bike, or eating an Impossible Burger, venture-backed companies are part of our everyday life. But, for every unicorn (venture terminology for a company valued at more than $1 billion), there are scores of companies that we never hear about due to the high rate of start-up failures.

Investments in venture capital are mainly in industries that develop new technologies and innovative new products and processes such as information technology, biotechnology, internet-based or consumer-related industries. While there are thousands of venture capital firms, the top firms, such as Accel, Benchmark, Sequoia, Andreessen Horowitz or Maryland-based New Enterprise Associates manage a large proportion of venture capital investments.

How Does Venture Capital Work?

After the start-up company’s founders have raised investments from friends and family and Angel investors, the next financing typically will come from venture capital firms.

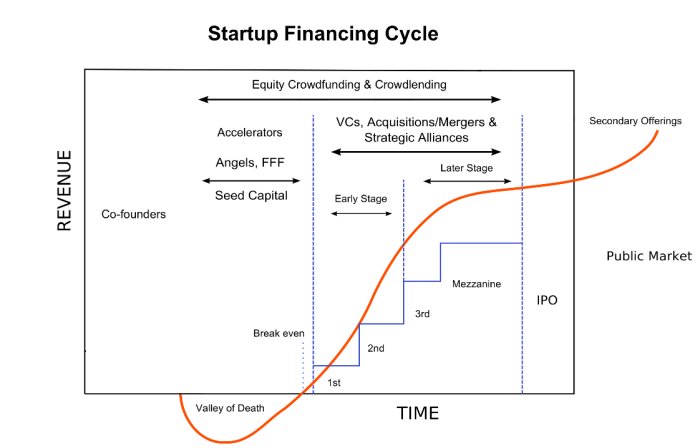

Venture capital firms create funds for investors, referred to as limited partners, and invest in numerous early stage to later stage companies (see Figure 1). While some wealthy families and individuals might invest directly in VC funds (assuming they meet the definition of an “accredited investor” as defined by the SEC), most limited partners represent larger entities, such as pension funds, endowments, and charitable foundations.

Figure 11

1 Source: Kmuehmel, VC20 - https://commons.wikimedia.org/wiki/File:Startup_financing_cycle.svg, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=41190293

Patience is a virtue when investing in VC. According to Venturebeat.com, the median time to exit for VC-backed companies in the U.S. has crept to 8.2 years for an IPO and five years for acquisitions or buyouts, the highest levels recorded in the last decade.

How Much Should I Invest in Venture Capital?

With the prospect of substantial returns compared to an investment in a publicly-traded company, investors should be willing to accept this high risk, illiquid and long-term investment.

It’s important to keep in mind that investing in venture capital is not a one-size-fits-all proposition. While some institutions may invest up to ten or even twenty percent of their assets into venture capital, this course of action may not be advisable for an individual. For instance, an endowment with an infinite time horizon can take on much more risk than a recent retiree that will rely heavily on their portfolio for income. In our experience, and while every investor is unique, we believe an individual should limit their exposure to private equity to fifteen percent and devote a smaller subset of this allocation to venture capital. This is complicated by the fact that VC funds call capital over the course of four to five years so maintaining your asset allocation becomes somewhat of an art. Besides having the wealth and risk appetite for venture capital investments, the most difficult part of this asset class is getting access to premier venture capital firms.

As always, consider consulting with a financial advisor to determine how much of your portfolio should be invested in venture capital.

Let the Certified Financial Planner™ professionals at Williams Asset Management help with your wealth management needs. Whether you need comprehensive and holistic financial planning or investment management, we can help! We are fee-based, independent financial advisors located in Columbia, the heart of Howard County, Maryland. Schedule your complimentary consultation today by calling (410) 740-0220!

Share on social media: