There is no denying that inflation is top of mind for everyone right now, especially as we approach the holidays. But, before you mark everyone on your list as “naughty” to avoid breaking the bank, let’s take a look at what you can do to approach the holiday season with confidence despite the rising cost of goods and services. Besides, the price of coal is up about 60% as of the end of October so this is not an enticing option either.

Times are Tough (Even for Santa)

Record inflation has been consuming the headlines and our wallets this year. And with the holidays approaching, consumers are bracing for more price shocks as they stress over their already stretched budgets. However, while high inflation has the potential to impact just about every aspect of our lives, we don’t necessarily have to let that be the case. It comes down to our personal choices about how we spend our money.

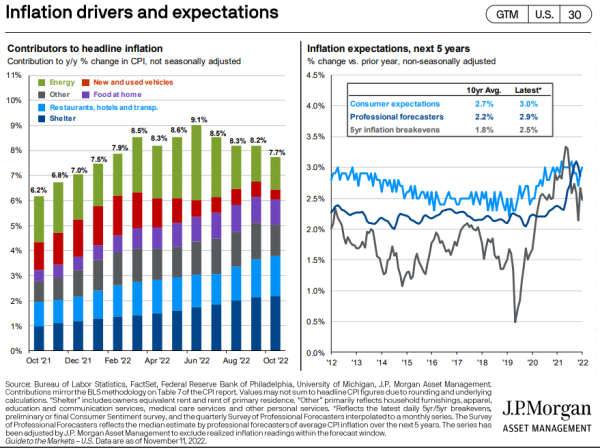

Although the inflation rate has been ticking down from its 9.1% year-over-year high in June, it remains stubbornly high at 7.7% in October. Though it is nice to note that this figure is down from 8.2% in the prior month of September. Nonetheless, consumers are continuing to pay more for essential goods than a year ago. On a year-over-year basis, food and energy prices continue to lead the way with double-digit increases, though they have eased somewhat in the last several months.

The shifting demand from goods to services is also reducing inflationary pressures on durable goods. In fact, due to the normalization of supply chains and falling demand, prices of various goods have fallen relatively significantly. Commodity prices have been trending lower for several months, reducing pricing pressure on durable goods, which had been the primary cause of surging core inflation.

So, What Isn’t More Expensive This Year?

What does this mean for consumers? Through August of 2022, the prices of some electronics, such as televisions, video equipment, smartphones, and telephone hardware, have fallen double digits.

Further, driven by declining gold and silver prices, jewelry is also more affordable than it was a year ago. Gold is down 6% from a year ago, and silver has come down 14%. Both of these commodity prices are historically very volatile, so don’t let the relatively minor price changes deceive you.

For sports enthusiasts, the cost to attend sporting events has declined by nearly 11% from last year.

Airline fares remain elevated, though the cost of travel overseas is less expensive due to the dollar’s value appreciating compared to other currencies in 2022.

New car prices are starting to decline and used car prices are down 11% over the last year.

For example, energy prices are a contributor to the CPI. Though, if you work remotely or commute to work by public transportation, your household may not feel the impact of rising energy costs in your day to day. Or, if you stop eating out (another component of the basket), your food costs won’t increase as fast. Ultimately, headline inflation has been historically high for the last year, though by taking a look under the hood of your budget on a periodic basis, you may be surprised by the control you have over your household’s personal inflation rate.

Counter Inflation with Planned Spending Habits

As difficult as it may be, consumers should ignore headline inflation and focus entirely on their household spending because that’s what they can control. While it’s impossible to completely dodge rising prices, focusing on goods with more stable or declining prices makes it possible to keep your budgets from breaking.

When it comes to holiday spending, consumers can exert that same control. While your holiday budget may not go as far as it has in the past, the key is making wise choices—shopping for discounts, using rewards points, and focusing on products such as electronics that have come down in price this year. And by all means, avoid stretching your holiday budget by using high-interest debt that could cause trouble down the road.

Airline fares remain elevated, though the cost of travel overseas is less expensive due to the dollar’s value appreciating compared to other currencies in 2022.

New car prices are starting to decline and used car prices are down 11% over the last year.

After rising sharply since 2020, energy prices have steadily declined since June. The energy price index has fallen 7.5% since October, though it is still up more than 18% from a year ago.

While this may be considered “cherry-picking,” it shows that some goods consumers want to buy are bucking the inflation trend. It also shows that consumers can control the impact of inflation on their households by “cherry-picking” the products they buy.

Headline Inflation vs. Household Inflation

For most American households, the government consumer price index (CPI) is not their reality. Their “household” inflation, based on their lifestyle choices, is a more realistic measure of rising prices for each family.

When measuring the monthly CPI, the Bureau of Labor Statistics looks at the prices of nearly 80,000 items divided into more than 200 categories. Those categories are folded into eight broad categories, including foods and beverages, housing, apparel, transportation, medical care, recreation, education, and communication. This is called the CPI market basket of goods. However, the CPI market basket of goods does not necessarily represent a particular household’s basket of goods and services.