A Certified Financial Planner’s Perspective: The Stock Market Meltdown Is Coming

By Gary S. Williams, CFP®, CRPC®, AIF®

Sometimes I get interesting responses when I tell a stranger what I do for a living. This morning, while I was out for a run on a beautiful, sunny day, I saw an older gentleman running. He was running rather slowly, and as I passed him, he told me he wished it were raining. I wasn’t quite sure I heard him correctly, so I asked him to repeat himself and, indeed, he said he wished it were raining. Before I knew what was going on, he suddenly started to run at my pace, and the next thing out of his mouth was to ask me what I did for a living. After I told him I was a financial advisor, he proceeded to share his résumé, the value of his investment portfolio, the fact that he just retired two weeks ago, and that he was nervous about investing a million dollars of cash due to the U.S. stock market hitting all-time highs. We ran together for about thirty seconds more, then he told me this is where he turns around and our conversation was over.

We ran together for only about three minutes, but it was his last comment that was the most memorable. It seems like every investor has been waiting for the market correction or the next recession since the last Great Recession in 2008. Maybe it’s because of the severity of last crash and recession. Or perhaps, people think that economic expansions die of old age. Well, they don’t. Economic expansions typically die for two main reasons: geopolitical risks and tight monetary policy.

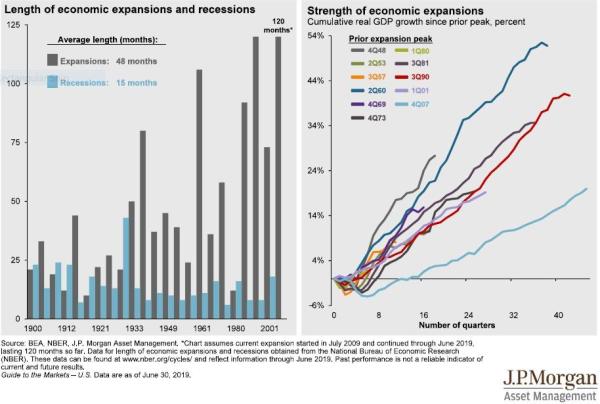

As you can see from the charts above, through June 2019, the current economic expansion is now the longest on record at 120 months. There are two interesting observations from these charts.

- The light blue line in the Strength of economic expansions chart shows the current expansion. Note that the current expansion is the longest on record, but it is not as steep (i.e., strong) as others have been. In other words, this expansion has been slow and lengthy.

- On the Length of economic expansions and recessions chart, you can see the average economic expansion lasts for four years and the average recession lasts for fifteen months. At the time I write this blog post in August 2019, we are in our 122nd month of the current expansion; well past the average of 48 months.

So, what conclusions can be drawn? First, strangers are willing to tell me a lot about themselves after meeting me on the street and knowing me for only thirty seconds. Second, another economic downturn and subsequent market meltdown will occur in the future, but since nobody knows when, you should not try to guess. Instead of being frozen in fear of investing at the wrong time or trying to time the market, consider two time-tested strategies: diversify your investments based on your risk tolerance and timeframe to your goals and consider dollar-cost averaging if you are moving funds from cash to a portfolio.

A certified financial planner can help with not only the technical aspect of investing but, just as important, the emotional part, which includes the periodic reminder not to try to time the market.

Let the CERTIFIED FINANCIAL PLANNER™ professionals at Williams Asset Management help with your wealth management needs. Whether you need comprehensive and holistic financial planning or investment management, we can help! We are fee-based, independent financial advisors located in Columbia, the heart of Howard County, Maryland. Schedule your complimentary consultation today by calling (410) 740-0220!

Share on social media: