Last week, we met with a prospective client that has a crystal-clear retirement plan. She is currently working for the government, and in ten years she wants to retire and follow her true passion which is physical fitness. She is in her late 50s but had the energy and physique of someone in their 40s. While we talked at length about staying fit, she was meeting with us for another purpose; she wanted guidance on her retirement planning. Through this conversation, we realized how interrelated retirement planning and investing is to dieting and staying fit.

First, dieting, like investing, is not easy. Both can be physically and mentally demanding. Each requires a level of dedication, discipline, and hard work, among other attributes. While these are words on a page or screen, anyone who has ever dieted or invested over a long period of time appreciates the meaning behind each of these words. To further complicate matters, each of us has a unique body and a unique retirement goal; so there is not a universal way to accomplish these aspirations. In other words, your age, financial situation, time horizon, discipline and more could all factor into how your financial plan and nutrition plan will be constructed. As we are both health-conscious financial advisors, the commonality in our opinion is that planning is one of the keys to a successful diet and retirement.

Another key to long-term success is balance. A well-balanced diet is just as important as a well-balanced investment portfolio. A diet may need the correct allocation of calories, protein, carbohydrates, and fats, while an investment portfolio may need the correct allocation of equity, fixed income, real estate, alternative investments, and cash. If you are a young college graduate, your retirement portfolio allocation will look materially different than someone who is 5 years away from retirement. Similarly, if you are 25, your diet and exercise regimen may be quite different then someone in their 70s. To illustrate, a 30-something investor could invest into their company’s 401(K) with an allocation of 80% stocks and 20% bonds (i.e. moderately aggressive) while the soon-to-be retiree could be perfectly opposite with 20% stocks and 80% bonds (i.e. moderately conservative).

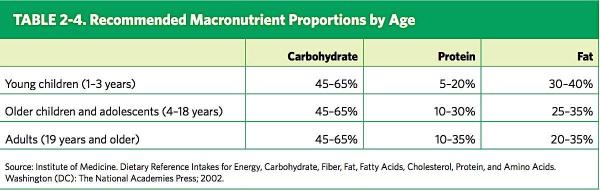

Third, sometimes you need a professional to provide guidance, while some can self-manage their diet and finances. In order to determine when you can self-diet or self-manage your investments and plan for your retirement, one of the first steps in this decision is understanding the resources at your disposal. With the age of the internet and information at our fingertips, we have more data then we sometimes know what to do with. For example, this information from the U.S Department of Health and Human Services, adults should intake 45-65% of carbohydrates, 10-35% protein, and 20-35% fat for proper nutrition. However, implementing this strategy can send you in many different directions, not knowing which one is the best. Having a professional (a dietician, nutritionist or a personal trainer) could bring success to your diet due to the fact that they also have the proper resources and knowledge to help you achieve your goals.

Next, think about what resources are available when it comes to investing your money. It is common that individuals do not have the proper tools, means, or even the free time to do this planning to achieve their retirement goals. Hiring an independent financial advisor can help provide you with these resources. They take the time with you to explore every financial facet of your situation to help set you on a path to financial independence.

As you can see, “investing” in the correct diet and investing your hard-earned money have many similarities. Whether a financial advisor or personal trainer helps you, taking the time to eat healthy and plan for a successful retirement can lead you into a healthy, successful life!

Let the Certified Financial Planner™ professionals at Williams Asset Management help with your wealth management needs. Whether you need comprehensive and holistic financial planning or investment management, we can help! We are fee-based, independent financial advisors located in Columbia, the heart of Howard County, Maryland. Schedule your complimentary consultation today by calling (410) 740-0220!

Share on social media: